Shortly before the financial crisis and concurrent housing bust, home prices in the Portland Metro area were soaring, much as they are today. My husband, Jeff, thought it would be fun to buy a house and flip it. I did not. We both had day jobs and we have a daughter, so spending weekends and evenings working on a house we’d never live in wasn’t appealing. However, the biggest reason was that it was a very risky proposition.

Oh sure, at the time it seemed like a good bet. The prices of single family homes were rising non-stop. You heard about flippers making a mint for going into a house and putting in new carpet and paint. Where was the risk?

The risk was in taking on debt in order to make the investment. Debt exacerbates the impact of any changes in the market value of an investment on your return. Of course that is a great thing when prices are going up, but it is a terrible thing when prices are going down. Say you pay $100,000 for a house with $10,000 of your own money and a $90,000 loan. It only takes a drop in prices of 10 percent to wipe out your investment. A larger drop and the sale of the property won’t generate enough to pay what you owe your bank.

The National Association of Realtors just reported that the average price for an existing single family home was up 6.3 percent in the first quarter of 2016 from a year ago. Prices are up in nine out of ten housing markets nationwide, and flipping is back in vogue. While it may be tempting to make a quick buck in today’s hot housing market, there are a few things to keep in mind before you jump in.

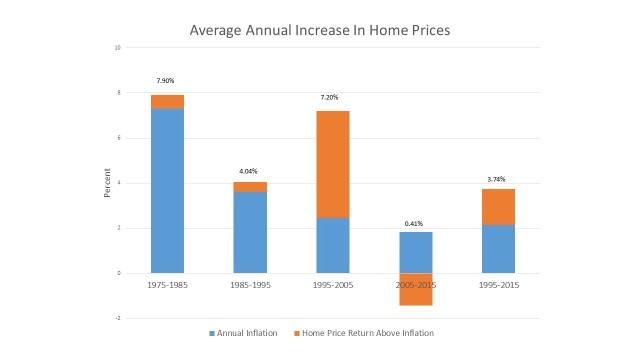

Historically speaking, houses aren’t a very good investment except as a place to live. In each of the last four decades, home prices have only increased in-line with inflation, with one big exception; 1995 to 2005. In that decade, home prices increased 4.75 percent more than inflation, but of course that was followed in the next ten years by an increase of only 0.41 percent, or 1.43 percent less than inflation. Over the two decades from 1995 to 2015, home prices were only up by 1.60 percent more than inflation on an annualized basis.

Source: Federal Reserve Economic Data, Case Shiller US Home Price Index, Bureau of Labor Statistics

Given how much work you have to put in and the transaction costs involved in buying and selling homes, not to mention property taxes, the historical picture just isn’t very compelling. Of course if you are lucky and time your flip well, there is profit to be had. The thing is when you insert the word “luck” into the equation, it starts to look more like gambling than investing. Had Jeff and I jumped on the band wagon of house flipping we could have very well lost our investment, or we could have wound up paying interest on the loan for years, waiting for the investment value to recover.

The average person usually only sees an opportunity when the window has been open a long time. That makes the timing of the investment precarious. There are a number of indications that the window of opportunity in the housing market may be narrowing. The first is the very fact that flipping is back in vogue. You have to worry about a market where speculators advertise their winning house flipping formula on the radio and in free seminars. In addition more markets are reporting that homes are selling above asking price. Home values are rising faster than incomes, and the average down payment for first time home buyers according to an article by Market Watch is now just 3.5 percent of the home value. All of this could lead to home prices stagnating or declining if the economy were to fall into a recession. That means the risk of making no money or losing your investment is increasing.

Successful flippers have years of experience in the residential real estate markets. They are better able to gauge the likely return relative to overall costs when they invest. They also have a reliable team of construction contractors that can get in and out of a project in a timely way. If you are considering going into a flip for the first time, you will be at a disadvantage in all of these aspects of the deal.

Real estate has a unique draw as an investment. It’s tangible, and it seems like you have greater control over the outcomes. Many people think they know more about the real estate market than they do, simply because they live in a house and are surrounded by other houses in their neighborhood. The stock market, in contrast, is esoteric. The gyrations of the S&P 500 index or the Dow Jones Industrial index seem to follow no logic, and you certainly cannot see and touch your investment. However, for most, these markets are a better place to invest.

In the stock market, transaction costs are low. You can buy an entire portfolio of stocks for a tiny fraction of a percent when you buy an index mutual fund. There is no work involved in buying an index fund, and while these markets are not for short term investments, over time the historical returns relative to inflation have been better than residential real estate. Before using your hard earned savings to invest in today’s hot housing market, carefully consider all of the costs and how much you really know about residential real estate. It’s better to leave high risk, debt funded investments like these to the pros.

Excellent points, Julie. What do you think about investing in REIT’s? I think Schwab and Vanguard have REIT ETF’s. Those ETF’s could be a way to invest in real estate without the high risk involved with flipping houses. Thanks.

LikeLike

Yes REITs are a good way to invest in Real Estate. They offer diversification, which a house flip does not, and the returns come from commercial rents as well as price appreciation. REITs are a good income generating investment alternative to dividend paying stocks as well.

LikeLike