Recently one of our neighbors put their house up for sale. It has roughly the same floor plan as our own. Their asking price made my jaw drop. Home prices in the Portland Metro area have been skyrocketing lately. Are you kidding me? Could we really sell our house for nearly half a million dollars? Being the analytical type, my joy at such luck usually lasts about a minute. And so it was in this case. I started thinking about all of the money we had put into the house, and wondered whether we were really ahead. For grins, my husband, Jeff, and I sat down and tallied all that we had invested. This was from memory, but I’m sure we are very close.

Before I give the gory details, I must tell you what we actually bought. I remember the day vividly. Sixteen and a half years ago, Jeff came home and told me I had to go check out this house. It wasn’t actually for sale yet, but they were having an estate sale, so I could walk through. I opened the front door of this 1972 gem to gold and beige shag carpeting in the hall so worn you could see the mesh. A quick turn through the old west bar style swinging doors into the kitchen revealed faux walnut cabinets and gold and brown foam carpeting. Through another set of swinging doors into the open dining and family rooms was more shag carpeting of the same color as the hall, formal harvest gold taffeta drapes and the ugliest fireplace I had ever seen. In fact most of the house was in harvest gold, except for the master bathroom, which was turquoise.

But there were windows everywhere and the ceilings were high. The light, even on a dark rainy Portland day, was amazing. The yard was beautiful. We seriously considered two other houses in the neighborhood, but wound up buying this one. The ugliest of the three. This, of course, is due to Jeff, who was able to see beyond all of the harvest gold. My initial response was “no way!”

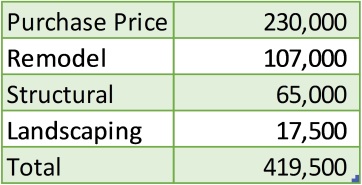

Obviously there was some work to be done. We initially did a cosmetic makeover using starter materials for about $35,000. But over the years we replaced the roof, the windows, the furnace and AC. We redid some of the initial remodel and had some unexpected expenses as well. We replaced a retaining wall we didn’t even know we had, because our rear fence sat on top of it, for example. Here is the total of sixteen years of investment.

According to Zillow our house is worth about $486,000 now. That probably is pretty close given where our neighbor listed his house and the fact that it sold quickly. So we have a gain of $66,500. But not so fast. Over the sixteen years we also paid $59,000 in property taxes and $48,000 in mortgage interest. OK, now we’re behind by $40,500. If we had been renting we wouldn’t have spent any of the money we did on fixing up the house, nor would we have paid property taxes or mortgage interest. Was it worth it?

Our current value minus total costs works out to a monthly rent of $211. To rent a house of our size in the same condition it’s in now we would have spent, on average, $1,800 per month, or $342,000 in total. Therefore, the answer is yes. Though we have spent more than the current value, we do have a thing of value in our home. Had we been renting all along we would have no value to offset the rent we paid.

This of course is just the financial side. It says nothing about the intangibles. Our house is where we raised out daughter, and where we gather with our friends. It holds our memories and mementos. Because it has value, it gives us security. We know we never have to leave.

Following the financial crisis and housing bust, people were understandably reluctant to buy a home. So many people owed more on their house than it was worth that it didn’t seem like a good deal. Since then home prices have recovered, and Zillow estimates that only about six million, or 7 percent of owner occupied homes are worth less than the owners owe on their mortgages. It may be daunting to buy a home, particularly in frothy markets like Portland. If you plan to live in your home long term, it is worthwhile. Both the math and the sentiments are in your favor.

Image courtesy of hywards at FreeDigitalPhotos.net

Julie,

Another great article with practical and sound advice. Thanks for sharing your wisdom! I always look forward to your posts.

LikeLike

Very good analysis, Julie. One other point to consider is that mortgage interest and property taxes may be deductible on state and federal tax returns, which would lower the net cost of owning a home. Renters don’t get that benefit.

LikeLike

Julie,

Hope all is going well, I love reading your blogs!

Do you have any advice on fractional share purchasing? I want to set up an account for my son to start him early on investing and saving and I thought this may be a good way to go.

>

LikeLike