As a saver, your first priority is to build up savings for an emergency, namely the loss of your job. Most people need at least three months of expenses set aside to bridge the gap between paychecks should the unthinkable happen. But where should you put your emergency savings?

The conventional wisdom says that you should deposit your emergency savings in a “safe” investment. A safe investment could be a savings account at your bank or credit union or a money market mutual fund at your favorite brokerage firm or mutual fund company. Unfortunately, in today’s low interest rate environment, these options don’t pay much more than simply burying your money in the back yard.

The typical bank pays you a whopping 0.01 percent on a savings account. If you have $10,000 saved, that will earn you $1 in a year. Vanguard offers a Federal Money Market Fund that pays 0.38 percent per year, or $38 for ten grand, and Fidelity offers a Government Money Market Fund that pays 0.20 percent per year, or $20 on your $10,000 in savings.

Of course there are investments that can be expected to provide a better investment return over time, but the operative phrase is “over time”. They all pose risks, and could leave you with less money than you contributed if you have to spend your money too soon. Here are the options and what might happen to your savings.

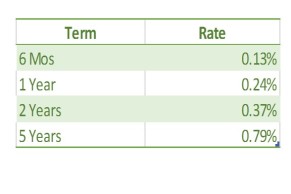

Stepping out just a bit from a bank savings account, you could invest your money in a certificate of deposit (CD). A CD is an account where you commit to leaving your money for a period of time, like six months, one year or longer. These accounts have somewhat higher interest rates. The following table shows current national average rates from the Federal Deposit Insurance Corporation (FDIC). However, if you withdraw your money early, you could wind up losing the interest earned and possibly paying fees, which could cause you to end up with less money than you started with.

At the national average rates, a money market mutual fund is a better deal, however there are CDs available with higher rates. Another option would be to invest in a short term bond mutual fund. Short term bond mutual funds invest in bonds with a few years to maturity. Bonds are essentially loans made to whoever issues the bonds. Both companies and governments issue bonds, and the interest rates they pay depend on their credit worthiness and how long until the bond matures, or in other words when the loan has to be paid back. Bonds and bond mutual funds will pay higher interest rates than the savings options listed so far, and there is no withdrawal penalty. But the value of your investment can fluctuate on a daily basis.

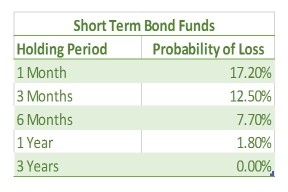

Using the yield on a composite of two year corporate bonds from the Treasury Department as a proxy for short term bond funds, I’ve calculated the returns and historical incidences of losses from 1984 through 2016. The results are in the following table. The current yield on this composite is 1.83 percent. A sampling of short term bond mutual funds had yields between 1.08 percent and 1.70 percent.

If you invested your emergency savings in a short term bond mutual fund, and you had to withdraw it in a month, there is a good chance, almost one in five based on historical returns, that you would pull out less money than you contributed. The longer you hold on to your savings, though, your risk of an absolute loss declines. Since 1984, there has never been a three year period that produced a loss in the Treasury Department’s two year bond composite. For holding periods with losses, the losses on a $10,000 investment were less than $300.

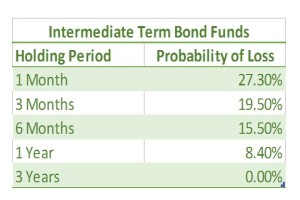

You could reach for a higher return by moving to longer term bond mutual funds. The next group of bond funds are called intermediate term bonds. These funds generally invest in bonds that mature in three to ten years. The longer until a bond matures, the greater the yield (usually), but also the greater the fluctuations in prices. Using the Treasury Department’s five year corporate bond composite, the historical incidence of losses are in the following table. The current yield on the composite is 2.62 percent, and the yield on a sampling of intermediate bond mutual funds ranged between 2.50 percent and 3.00 percent.

For the extra earnings, you do take more risk. If you have to withdraw your money within a month you stand a more than one in four chance that you will lose at least some of your contribution. Losses were bigger for this investment. In the worst case since 1984, the loss was almost 9.00 percent, or $900 on a $10,000 investment. That is starting to hurt. But as with short term bonds, these longer bonds historically have not lost money over three year holding periods.

The riskiest place to put your emergency savings is the stock market. For a one month holding period, it is virtually a gamble. The S&P 500 stock index has lost money in more than 40 percent of the months since 1950. Losses can be large, leaving you substantially short of your ability to cover your emergency. Like with the bond mutual funds, the incidences of absolute losses decline the longer you hold your stock market investments, but even ten year holding periods are not immune to losses.

A good rule of thumb is to match your investment to your holding period. If you will spend your money soon, keep it in a savings account or a money market mutual fund. If you will spend your money in the next three years, short term bonds and bond mutual funds are a good option. If you will spend your money sometime between three and ten years, intermediate bonds and bond mutual funds are reasonable. Only money that you won’t touch for ten years should be invested in the stock market.

So which holding period does your emergency savings fall into? You may never lose your job, but for most there is at least a small possibility that you could lose your job at any time. If you are just starting out and your emergency savings are all the savings you have, the conventional wisdom applies. You can’t afford to lose any of your money, so keep it in a savings account or a money market mutual fund. As you build up your savings, and you begin to save for other goals like retirement, you could get away with a bit of risk. Losses in short term bonds have been limited historically, so the extra yield may be worth the small risk.

Save the higher risk investments for your longer term goals. The whole point of having emergency savings is that it will be there when you need it. Low interest rates may be hard to accept, but they are easier to live with than having your emergency fund come up short.

Image courtesy of Tina Phillips at FreeDigitalPhotos.net

There is a lot of good information here. We have our emergency fund in an online bank savings account that is currently paying 1.00 APR. It is FDIC insured and it is easy to link this account to your local traditional bank account so that cash transfers are easy and take only a day or two to complete. We have been very satisfied with this arrangement.

LikeLiked by 1 person

Thanks Kim!

LikeLike

Hi Julie,

I hope things are going well for you. I read this today and I wanted to let you know that this article is helpful for me personally. Thanks for sharing this information.

LikeLike

Thanks for letting me know Brian! Hope you and your family are doing well!

LikeLike

Greetings! Veery helpul advice within his post! It is

tthe little chanjges whic wkll mame thee greaest changes.

Thankms a lott for sharing! I coould not refrain fropm commenting.

Perfeectly written! I could nnot refrrain fom commenting.

Exceptionally werll written! http://cspan.co.uk

LikeLike

Thank you for reading!

LikeLike

This is the article I was looking for! Very informative yet concise.

My question is related to online savings accounts. A lot of people seem to use Ally, but First Foundation and Fitness Bank seem to have higher APYs right now. Do you have thoughts on this? I know they are FDIC insured, but curious if you or others have heard of them…

LikeLike

Thanks Leslie! There are a bunch of on-line savings accounts, and since they are FDIC insured, there is not a lot of difference in risk among them. But do pay attention to the details. Some accounts limit the number and/or size of withdrawals. For an emergency fund, that is not a big deal, but something to be aware of. Also consider that opening rates may not last long. Many banks do offer teaser rates to get you in the door, but then drop them later. Nerdwallet does a regular roundup of high yield savings account. Here is the latest. https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts.

LikeLike