Are you having trouble finding ways to save money? Maybe you’ve whittled away at your expenses, and you still aren’t making the progress you’d like. There may be one place that you haven’t looked. There are huge savings sitting in your garage.

Owning a car is expensive. And that doesn’t even take into account how much they cost to buy. There are the operating expenses of gas, maintenance and tires, and there are the ownership expenses of licensing, registration, taxes, and insurance. If you borrowed money to buy the car you’re paying interest on the loan, and cars decline in value every year.

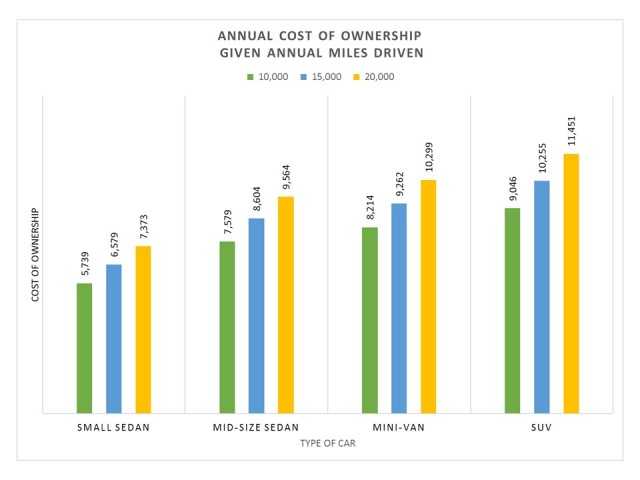

Each year AAA estimates the annual cost of ownership of different vehicles, taking all of these expenses into account, given how many miles you drive in a year. The chart below summarizes the information. The average is over $9,500 a year. If you work in an urban area, you may pay for parking, so add another $2,000 to each of the numbers in the chart.

The good news is the less you drive your car, the less it costs you. But if you don’t drive your car very much, do you need it at all?

If you live and work in a major metropolitan area, the American Public Transportation Association estimates the average driver could save over two thirds the cost of owning a car if they switched to public transit. That takes care of getting to work, and maybe you already commute that way. But what about the rest of the time?

On nights and weekends you go to places where public transit is far less convenient. Things like grocery shopping and other errands could be a nightmare without a car. But just because you don’t own a car doesn’t mean you can’t use one.

Car sharing services are now widely available. With Cars 2 Go you can rent a car for $15 per hour or $59 per day, gas, insurance and parking all included. With Zip Car, a monthly membership fee of $7 per month will get you a car at $8 per hour with gas and insurance included.

Say you want a car once a week for shopping and errands, and you use it for half the day. With Cars 2 Go, it will cost you a little over $3,000 per year. That’s just a bit over half what it costs you to own a small car driving $10,000 miles per year.

What about those weekend getaways? With Zip Car, you can keep the car for up to 7 days, or you could rent a car from a car rental company such as Enterprise or one of the other national chains. You can rent just the car you need; an SUV for camping, or a cute convertible for a drive up the coast. You will need insurance to rent from one of these companies, but most major insurers offer non-owner insurance which is often cheaper than insurance on a vehicle that you do own.

If you are a two car family, getting rid of one of your cars may be even more feasible. You’ll still have the convenience of owning a car, but you can reduce your expenses by eliminating one of them.

If after some hard thought, you just don’t see how you could reasonable give up a car, then make sure you have the car you need. Years ago, my husband, Jeff and I, got rid of our Ford Explorer and bought a Toyota Prius. The Explorer was terribly expensive to operate. It only got 14 miles to the gallon of gas. But we thought we needed it for camping and home projects.

When we sat down and thought about it through, we found we were keeping the gas guzzler for things that applied to maybe 3 percent of the trips we took in it. We figured if we needed something bigger for those trips, we could rent it.

We’ve done all kinds of home projects in the Prius. We’ve only had to rent a truck once. And the Prius is much cheaper to operate, getting at least 45 miles to the gallon and requiring less maintenance due to the hybrid engine.

The number of households that don’t own a car at all has increased to over nine percent from it’s low in 2010. However, on average, Americans still have more cars than drivers. It may be time to think differently about your transportation. If you’ve been struggling to find ways to save money, a solution may be sitting in your garage.

Image courtesy of Nanhatai8 at FreeDigitalPhotos.net

In some ways, living in a big city and not having a car is more convenient than having one. Seeing friends of mine live comfortable and active lives without cars motivated me to try living without one as an experiment. I’ve been saving a bundle by not having the auto related expenses and two years later the experiment continues – I still don’t have a car.

LikeLike