Both the Dow Jones Industrial Average and the S&P 500, the venerable U.S. stock market indices, closed near record highs on Friday, October 13th. Both indices have been steadily climbing all year. The Dow, including dividends, is up 17.92 percent and the S&P, also including dividends, is up 15.86 percent just this year.

The run up has investors waiting for the other shoe to drop. Surely the next move can only be down. Every week there are articles discussing whether we are on the verge of another stock market bubble bursting. You’ve worked hard for your savings, and nothing is worse than seeing a big hole in the value of your nest egg. So should you sell your stock market investments to avoid that?

To see how it might turn out, look at what happened following the last stock market peak, in September of 2007, just before the financial crisis. If you had perfect foresight you would have sold then, and avoided the following drop in value of 51 percent. Then you would have bought back your investment at the low in February of 2009. By now your investment would have more than tripled.

But let’s be realistic. We only have perfect hindsight. We know nothing about the future. We can’t tell whether we are at a peak or just a nice view point along the way. And we certainly won’t be able to tell when the market has hit bottom.

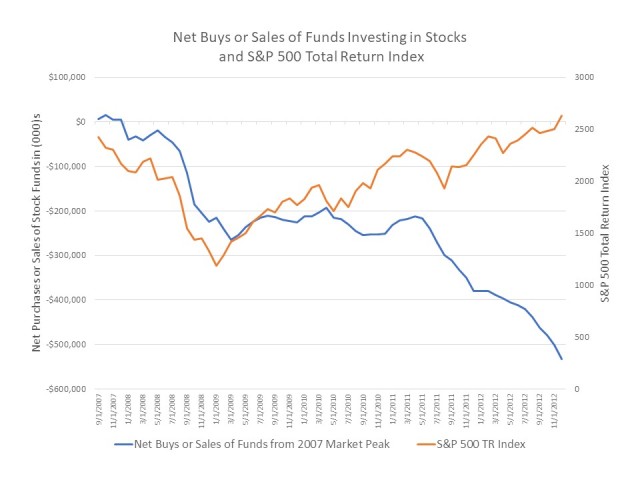

To get a sense of what most investors did following the stock market peak in 2007, we can look at investor net buys or sales of mutual funds and exchange traded funds investing in the stock market during the time period. In the following chart, fund net buys (actually sales because they are negative) are in blue and the S&P 500 Total Return Index is in orange.

Yes, investors began taking money out of the stock market as it began to decline from it’s highs. But they continued to take money out even as it rebounded. As the market surpassed it’s previous peak investors were still withdrawing money. It wasn’t until the end of 2012 that stock funds began to see steady net buys.

The biggest monthly net sale was in October of 2008 and the biggest monthly net buy following that was January of 2013. If you had sold and bought back in those months your return from September of 2007 through October 13, 2017 would have been just 11.89 percent, or about 1.3 percent per year.

Even being off by a few months would have cost your returns. If you didn’t sell until December 2007 and didn’t buy until May 2009, your money would have only doubled instead of tripled. If you had waited another six months on both ends, your money would be only 1.5 times more than at the 2007 peak.

What if you had done nothing? If you had not touched your stock market investments, by now your money would have more than doubled. Doing nothing is certainly easier than picking both the top and bottom of the stock market. Steadily adding to your investments, as you would in your retirement account, would have been even better.

Where stock market declines become devastating is when you have to withdraw your money during the decline to meet expenses. To avoid that, don’t invest any money you will need to spend in the next ten years there. Anything that you won’t need for more than ten years can stay invested in the stock market. Historically, the S&P 500 has finished higher than it started in 26 out of every 27 ten-year periods.

Of course there will be another market down-turn. But no one knows when or how severe it will be. In the mean time you need your savings to grow for your long term goals, like retirement. So no, don’t get out of your stock market investments now and in fact keep adding to them. If you have more than ten years before you need to spend your money, you have plenty of time for your savings to recover from the next down-turn, whenever that is.

Sources: Yahoo Finance S&P 500 Total Return Index and Data Hub US Investor Flow of Funds

Image courtesy of Idea go at FreeDigitalPhotos.net