My husband, Jeff, recently turned 60. It’s an interesting age. It’s as if you’ve crested some hill, and can now see retirement laid out before you. Jeff has been retired for five years, but his friends who are still working are starting to think seriously about what’s next. Conversations on the topic inevitably turn to Social Security claiming strategies.

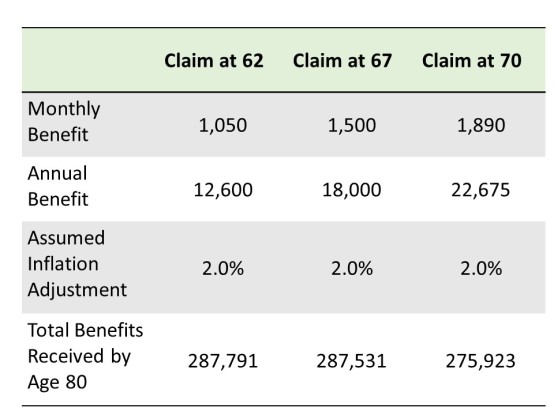

Should I take it early, at age 62, is the usual question. A few have done some math to arrive at a dubious conclusion. If you assume you live to a certain age, say 80, you will get the same amount, in total, from Social Security whether you claim it at 62 or the normal retirement age of 67, despite the larger benefit. If you wait until you are 70, you’ll actually get less money. Here is an example of the calculation.

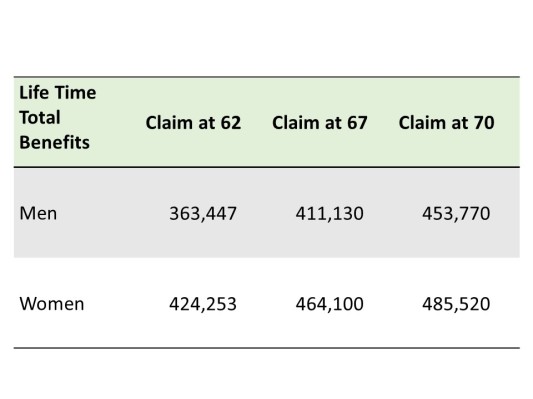

The first problem is you’re not likely to die at age 80. In the absence of some known health issue, at the age of 62, men can expect to live to be 84, and women can expect to live to be 87, according to the Social Security Life Expectancy Calculator. That change alone makes a significant difference in the total benefit you can expect to receive, and claiming at 62 no longer makes sense, if your goal is to maximize your life time total benefits.

If you live to be 80, it turns out you are likely to live to be 89 if you are a man and 90 if you are a woman. At those ages, the difference in life time benefits between claiming early and claiming at the full retirement age grows to $52,000 and $58,000 respectively.

But all of these calculations miss an important purpose of Social Security. It is a guaranteed income that supplements your retirement savings. If you wait to claim Social Security until your full retirement age, or later, the larger benefit will allow you to take less from your savings, and therefore your savings will last longer. Since you really don’t know how long you will live, you need your savings to last as long as possible.

Say that you have $1 million saved for retirement and you need $60,000 per year to maintain your current lifestyle. Also assume your savings will earn 5.0 percent per year. If you claim Social Security at age 62, your savings will only last until you are 92, whereas if you wait until age 67 to retire and claim Social Security, the higher benefit means you are not likely to run out of money ever.

If you consider that things may not work out as planned, that extra buffer is even more important. About two thirds of people over the age of 65 are expected to need long term care sometime in their life, according to a paper by the Society of Actuaries. Long term care will sap your savings quickly. The higher social security benefit you receive at the full retirement age will leave you with more savings to deal with these higher expenses.

A higher benefit will also provide you a buffer against the vagaries of the market. Your savings won’t earn 5.0 percent every year. Some years it will earn more and some less. The larger your Social Security benefit the better you will be able to maintain your lifestyle in the event returns aren’t as high as expected.

Maximizing your lifetime Social Security benefit shouldn’t be your primary goal. Making sure you have enough money to last your lifetime should be. You are more likely to realize the latter goal if you wait to take Social Security until your benefit is higher.